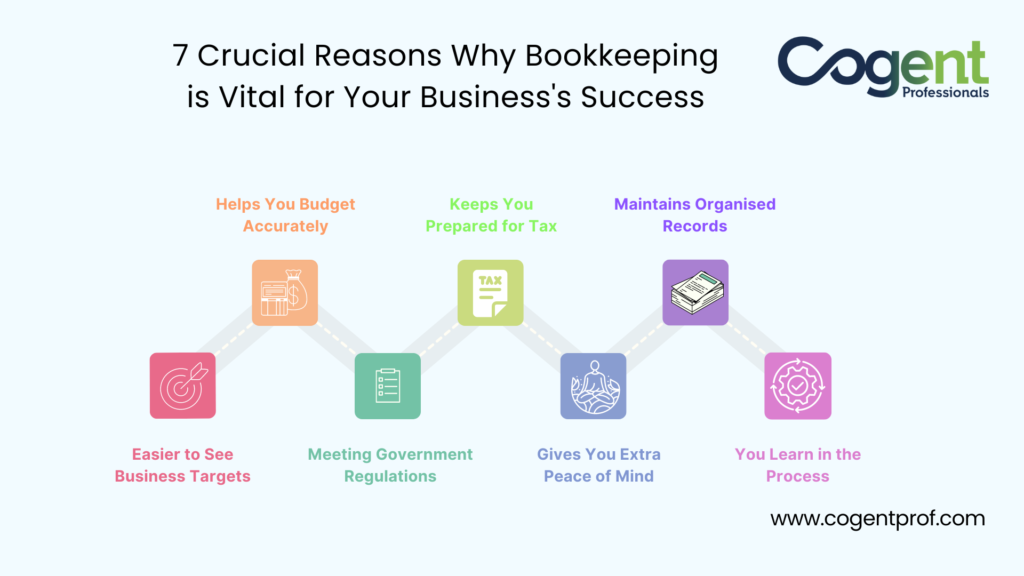

7 Crucial Reasons Why Bookkeeping is Vital for Your Business’s Success

Maintaining proper bookkeeping practices is indispensable for any business, offering numerous benefits such as accurate budgeting, tax preparedness, organizational efficiency, and more. Here are seven compelling reasons why prioritizing bookkeeping is essential for the success of your business:

Facilitates Accurate Budgeting:

Bookkeeping streamlines the budgeting process by meticulously organizing income and expenses, providing a clear overview of financial resources and costs. A well-defined budget serves as a financial roadmap, aiding in planning for future expenses and fostering business growth. Without accurate and up-to-date records, budgeting becomes a mere exercise in guesswork.

Ensures Tax Preparedness:

With consistent bookkeeping practices, businesses are better prepared for tax obligations, avoiding last-minute scrambles and potential penalties. Detailed financial records enable accurate prediction of tax outcomes, ensuring compliance with HMRC requirements and minimizing stress during tax season.

Maintains Organized Records:

Regular bookkeeping prevents the chaos of last-minute searches for crucial business information, reducing the likelihood of missed deadlines and errors. By staying proactive and keeping records up to date, businesses can effortlessly access vital information when needed, enhancing efficiency and reliability.

Facilitates Goal Setting:

Clear and accurate financial records are essential for setting achievable business targets. Without reliable data for analysis, it becomes challenging to establish growth goals and measure progress effectively. By maintaining meticulous records, businesses can map out goals more accurately and strategize for sustainable growth.

Ensures Compliance with Regulations:

Adhering to government regulations, such as Making Tax Digital (MTD) initiatives, is imperative for businesses. Digital bookkeeping not only fulfills regulatory requirements but also streamlines the tax process through the use of applications and software. Utilizing user-friendly apps simplifies compliance efforts and eliminates the need for costly outsourcing.

Provides Peace of Mind:

Well-organized books alleviate the stress and anxiety associated with financial uncertainty and regulatory compliance. With tidy financial records and timely tax filings, business owners can enjoy peace of mind, knowing that their financial information is in order and ready for review, allowing them to focus on core business activities.

Facilitates Continuous Learning:

Engaging in bookkeeping activities, whether through digital platforms, workshops, or online resources, presents valuable learning opportunities for business owners. By gaining insights into their finances, individuals can make informed decisions and enhance their financial literacy, ultimately contributing to business success.

Now that the importance of bookkeeping is clear, take proactive steps to implement effective bookkeeping practices in your business. Access our free checklist for valuable tips on bookkeeping and leverage professional support from Cogent Professionals to optimize your financial management processes and achieve greater success. Start your journey towards financial efficiency today!

Visit us: www.cogentprof.com

Email: [email protected] | +91 86961 99999