15 Dec

Determining a Company's Tax Residency Through Place of Effective Management [PoEM]

The Place of Effective Management (PoEM) is a crucial factor in determining the residential status of companies established in foreign jurisdictions, particularly in the context of tax treaties involving India. This criterion holds significant importance and serves as a pivotal element in preventing occurrences of double taxation.

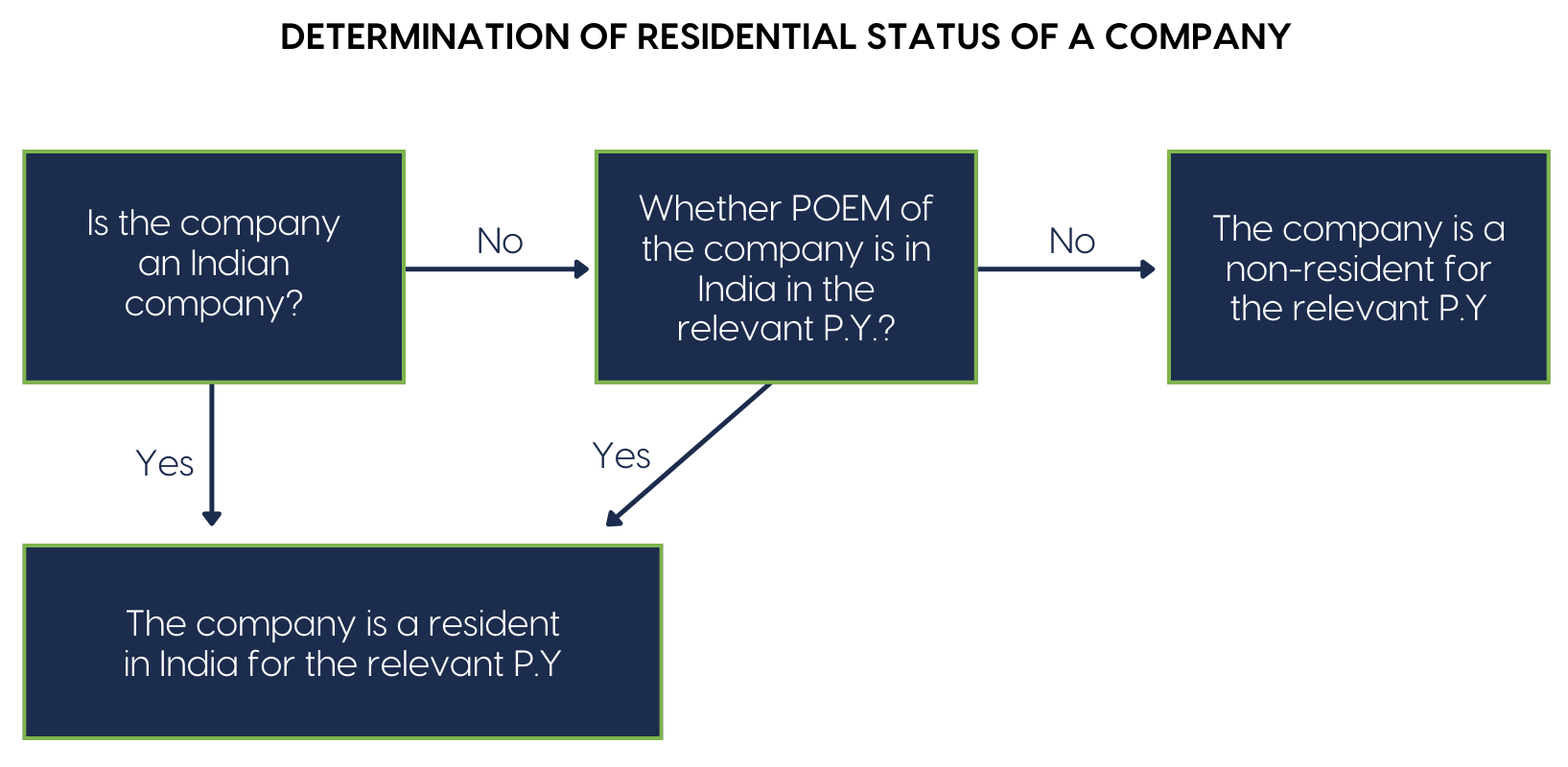

According to section 6(3) of the Income-tax Act, 1961, a company is deemed a resident of India if it meets either of the following conditions:

a) It qualifies as an Indian company.

b) Its place of effective management is situated in India.

b) Its place of effective management is situated in India.

In essence, PoEM acts as a decisive factor in delineating the tax obligations of foreign-based companies, ensuring clarity and fairness in the global taxation landscape.

The term “Place of Effective Management” (PoEM) refers to the pivotal location where crucial management and commercial decisions essential for the overall functioning of an entity are made.

Commercial decisions encompass significant choices such as:

a) Initiating a major manufacturing facility

b) Ceasing a substantial product line.

b) Ceasing a substantial product line.

For Income Tax purposes, the determination of residential status must be conducted annually, necessitating the assessment of PoEM on a yearly basis. However, it’s noteworthy that these PoEM provisions do not extend to companies with a turnover or gross receipts of Rs 50 crore or less in a financial year.

The guiding principles for establishing PoEM include:

Active Business Outside India (ABOI) Test

Key Management Test

Head Office Test

Miscellaneous

Key Management Test

Head Office Test

Miscellaneous

These principles collectively aid in pinpointing the precise location where decisions crucial to the entity’s operations are formulated.

1) Active Business Outside India (ABOI) test

The Active Business Outside India (ABOI) test determines the Place of Effective Management (PoEM) of a company. If a company engages in active business outside India, its PoEM is presumed to be outside India when the majority of its board meetings are conducted abroad. For a company to qualify as having ABOI, it must meet the following criteria:

a) Passive Income Threshold:

The company’s passive income, comprising income from the exchange of goods with associated enterprises and earnings from royalty, dividend, capital gains, interest, or rental income, should not exceed 50% of its total income.

b) Asset Location:

Less than 50% of its total assets should be situated in India. For depreciable assets, the value is calculated as the average of the Written Down Value (WDV) at the beginning and end of the financial year. If asset valuation is not required for tax purposes, the value will be based on the company’s books of account.

c) Employee Distribution:

Less than 50% of its total number of employees should be located in India or be residents of India. The total number of employees is determined by averaging the count at the beginning and end of each year.

d) Payroll Expenses:

The payroll expenses incurred on these employees should be less than 50% of the company’s total payroll expenditure. The term ‘payroll’ encompasses salaries, wages, bonuses, and all other employer-paid employee costs.

Note: These ratios are to be evaluated based on the average of the data from the previous year, with consideration given to the two years preceding it.

2) Key Management Test

The assessment of Place of Effective Management (PoEM) for companies within India involves a two-stage evaluation when the Active Business Outside India (ABOI) is not a factor:

i) Identification of individuals responsible for pivotal management and commercial decisions encompassing the entire company,

ii) Determination of the location where these decisions are formulated.

It is crucial to note that, in determining a company’s PoEM, the emphasis lies more on the place where commercial decisions are made rather than where they are executed.

The critical decisions steering the company can emanate from:

(i) The board of directors,

(ii) An executive committee duly authorized by the board, or

(iii) Senior management acting within the bounds of board authorization.

ii) Determination of the location where these decisions are formulated.

It is crucial to note that, in determining a company’s PoEM, the emphasis lies more on the place where commercial decisions are made rather than where they are executed.

The critical decisions steering the company can emanate from:

(i) The board of directors,

(ii) An executive committee duly authorized by the board, or

(iii) Senior management acting within the bounds of board authorization.

3) Head Office Test

The assessment of a company’s Place of Effective Management (PoEM) hinges significantly on the strategic positioning of its Head Office. Several key considerations come into play when determining the location of a company’s head office:

i) In cases where the senior management and support staff are centralized in a single location, that specific place becomes the designated head office of the company.

ii) For companies adopting a more decentralized structure, where senior management members are dispersed across various locations, the head office is identified as the primary location where these senior executives are based. This could also be the place they habitually return to after traveling or where they convene to make pivotal decisions crucial to the company’s operations.

iii) If the senior management is spread across different locations but engages in meetings through remote means such as telephone or video conferencing, the head office is then determined to be the location where the highest echelon of management, such as the Managing Director or Financial Director, is situated.

iv) In instances where a company’s decentralization is so extensive that pinpointing a specific head office becomes impractical, the location of the head office becomes irrelevant in determining the PoEM.

It’s important to note that while a company may have multiple places of management, there can only be one effective place of management in any given case. The determination of PoEM remains contingent upon the unique facts and circumstances of each situation.

i) In cases where the senior management and support staff are centralized in a single location, that specific place becomes the designated head office of the company.

ii) For companies adopting a more decentralized structure, where senior management members are dispersed across various locations, the head office is identified as the primary location where these senior executives are based. This could also be the place they habitually return to after traveling or where they convene to make pivotal decisions crucial to the company’s operations.

iii) If the senior management is spread across different locations but engages in meetings through remote means such as telephone or video conferencing, the head office is then determined to be the location where the highest echelon of management, such as the Managing Director or Financial Director, is situated.

iv) In instances where a company’s decentralization is so extensive that pinpointing a specific head office becomes impractical, the location of the head office becomes irrelevant in determining the PoEM.

It’s important to note that while a company may have multiple places of management, there can only be one effective place of management in any given case. The determination of PoEM remains contingent upon the unique facts and circumstances of each situation.

4) Miscellaneous Considerations

In cases where the factors mentioned earlier do not distinctly establish the Place of Effective Management (POEM), additional secondary factors come into play. These include:

i) Location where the primary activities of the company are conducted; or

ii) Location where the company’s accounting records are maintained.

These supplementary criteria contribute to a comprehensive assessment, offering further insights into determining the POEM when the primary factors may not yield a clear conclusion.

i) Location where the primary activities of the company are conducted; or

ii) Location where the company’s accounting records are maintained.

These supplementary criteria contribute to a comprehensive assessment, offering further insights into determining the POEM when the primary factors may not yield a clear conclusion.

Example 1:

IQL INC., a sourcing entity for a leading Indian multinational group, is incorporated in the United States as a 100% subsidiary of VQL Ltd, an Indian company. The sole assets of the company are warehouses located in the USA, and all employees are based in the country. Over the past three years, the company’s total income can be categorized as follows:

i) 30% of income originates from transactions where purchases are made from non-associated enterprises and subsequently sold to associated enterprises.

ii) Another 30% of income is derived from transactions involving purchases from associated enterprises and subsequent sales to associated enterprises.

iii) An additional 30% of income is generated through transactions where purchases are made from associated enterprises and sold to non-associated enterprises.

iv) The remaining 10% of income is in the form of interest.

ii) Another 30% of income is derived from transactions involving purchases from associated enterprises and subsequent sales to associated enterprises.

iii) An additional 30% of income is generated through transactions where purchases are made from associated enterprises and sold to non-associated enterprises.

iv) The remaining 10% of income is in the form of interest.

Interpretation:

In this scenario, passive income constitutes 40% of the company’s total income. This passive income is comprised of:

i) 30% from transactions where both the purchase and sale involve associated enterprises.

ii) 10% from interest. IQL INC. fulfills the initial requirement of the active business test outside India. Given that neither assets nor employees of IQL INC. are situated in India, the company satisfies the other criteria of the test. Therefore, it can be concluded that the company is actively engaged in business outside India.

ii) 10% from interest. IQL INC. fulfills the initial requirement of the active business test outside India. Given that neither assets nor employees of IQL INC. are situated in India, the company satisfies the other criteria of the test. Therefore, it can be concluded that the company is actively engaged in business outside India.

Example 2:

In the context of IQL INC, we revisit the scenario presented in Example 1, but with a distinctive element. IQL INC boasts a workforce of 50 employees, with the majority—47 employees—dedicated to managing the company’s warehouse, storekeeping, and accounts, all stationed in the USA. Meanwhile, the key leadership roles, including the Managing Director (MD), Chief Executive Officer (CEO), and sales head, are based in India. The overall annual payroll expenditure for these 50 employees amounts to INR 5 crore, with INR 3 crore specifically allocated to the MD, CEO, and sales head.

Interpretation:

Upon analysis, it is evident that the initial condition of the active business test is met, given that only 40% of IQL INC’s total income is passive. Moreover, over 50% of the workforce operates outside India, and all company assets are situated abroad. However, a critical point arises as the payroll expenditure related to the MD, CEO, and sales head—who are Indian residents—surpasses 50% of the total payroll expenditure. This specific factor leads to the conclusion that, despite satisfying certain criteria, IQL INC cannot be deemed as actively engaged in business outside India.

Example 3:

The fundamental details align with those in Example 1. Adding to these, it’s noteworthy that every director at IQL INC is a resident of India. In the pertinent previous year, the Board of Directors convened for 5 meetings, with two in India and three abroad—specifically, two in the USA and one in the UK.

Interpretation:

Scrutinizing the facts as laid out in Example 1, it is evident that IQL INC actively conducts business beyond the borders of India. The preponderance of board meetings transpiring outside India implies that the Presumptive Place of Effective Management (POEM) for IQL INC is to be considered as being outside India.

Example 4:

The circumstances mirror those outlined in Example 3, with the additional revelation that the Assessing Officer has confirmed a crucial aspect: while the senior management team at IQL INC signs all contracts, decisions on contracts exceeding INR 10 lakh require a recommendation from IQL INC to be submitted to VQL Ltd. It is VQL Ltd that ultimately decides whether to accept or reject these contracts. Notably, more than 99% of contracts during the previous year exceeded the INR 10 lakh threshold, and this pattern has persisted over several years.

Interpretation:

These details strongly indicate a substantial influence from the parent company, VQL Ltd, over the effective management of IQL INC. Consequently, even though IQL INC actively conducts business outside India and conducts a majority of its board meetings abroad, it is suggested that the Place of Effective Management (POEM) for IQL INC should not be presumed to be outside India in such instances. The preeminent role played by VQL Ltd in decision-making implies a significant influence that shapes the POEM considerations for IQL INC.

Example 5:

An Indian multinational conglomerate operates through its local holding company, A Co., situated in country X. A Co. oversees 100% downstream subsidiaries, namely B Co. and C Co. in country X, and D Co. in country Y. A Co.’s income is derived exclusively from dividends and interest generated by investments in its subsidiaries. The Place of Effective Management (POEM) for A Co. is located in India and is administered by the ultimate parent company of the group. Notably, subsidiaries B Co., C Co., and D Co. are actively involved in business operations beyond India, with board meetings conducted in country X and Y for B Co. and D Co., respectively.

Interpretation:

Merely having the POEM of an intermediate holding company in India does not automatically imply that the POEM of its subsidiaries shares the same jurisdiction. It is imperative to individually assess each subsidiary. In the presented scenario, despite A Co.’s POEM being in India, the subsidiaries B Co., C Co., and D Co. operate independently, engaging in active businesses outside India. The majority of their board meetings also take place beyond India. Consequently, the presumption is that the POEM of B Co., C Co., and D Co. lies outside the borders of In

Example 6:

VDKS Inc., a Swedish company with its headquarters in Stockholm, lacks a permanent establishment in India. However, it established a liaison office in Mumbai in April 2023, adhering to RBI guidelines. The purpose of this office is to oversee day-to-day business operations in India, promote awareness about the company’s products, and explore potential opportunities. The liaison office is involved in making decisions related to routine operations and handles support functions that are preparatory and auxiliary. Nonetheless, significant management and commercial decisions remain the prerogative of the Board of Directors in Sweden.

Interpretation:

In this scenario, VDKS Inc. being a foreign company would be considered a resident in India for the Previous Year (P.Y.) 2023-24 only if its place of effective management in that year is in India. Despite having a liaison office in India, the location where decisions pertaining to day-to-day operations and preparatory or auxiliary support functions are made does not impact the determination of the place of effective management. Consequently, VDKS Inc., as a foreign company, maintains its non-resident status for the Assessment Year (A.Y.) 2024-25, given that its place of effective management remains outside India in the P.Y. 2023-24.