DISPUTE RESOLUTION PANEL (DRP)

The entry of international businesses into the Indian market not only expands the avenues for tax collection in the country but also underscores the need for a robust Revenue department capable of effectively addressing growing disputes. The Finance Bill of 2009 introduced an extra avenue to aid in the resolution of transfer pricing matters through the establishment of the Dispute Resolution Panel (DRP).

The DRP serves as an Alternative Dispute Resolution (ADR) mechanism specifically designed for addressing disputes pertaining to Transfer Pricing in International Transactions. Its establishment aims to ensure the prompt and equitable resolution of cases in a fair and just manner.

The assessees who can opt for resolution under the Dispute Resolution Panel are

- foreign companies and

- those assessees against whom an unfavourable order has been passed by a Transfer Pricing Officer.

The panel shall have its headquarters at Delhi, Mumbai and Bengaluru with jurisdiction as prescribed.

The Dispute Resolution Panel is a body constituted by the Central Board of Direct Taxes (CBDT) and is a collegium consisting of three Commissioners of Income-tax.

When can resolution be sought under DRP?

The entry of international businesses into the Indian market not only expands the avenues for tax collection in the country but also underscores the need for a robust Revenue department capable of effectively addressing growing disputes. The Finance Bill of 2009 introduced an extra avenue to aid in the resolution of transfer pricing matters through the establishment of the Dispute Resolution Panel (DRP).

The DRP serves as an Alternative Dispute Resolution (ADR) mechanism specifically designed for addressing disputes pertaining to Transfer Pricing in International Transactions. Its establishment aims to ensure the prompt and equitable resolution of cases in a fair and just manner.

Matters to be considered by DRP

- Draft order

- Objections filed by the assessee

- Evidence furnished by the assessee

- Report of any authority (like Assessing Offer, Transfer Pricing Officer or Valuation Officer)

- Records relating to the draft order

- Evidence collected

- Result of enquiries made.

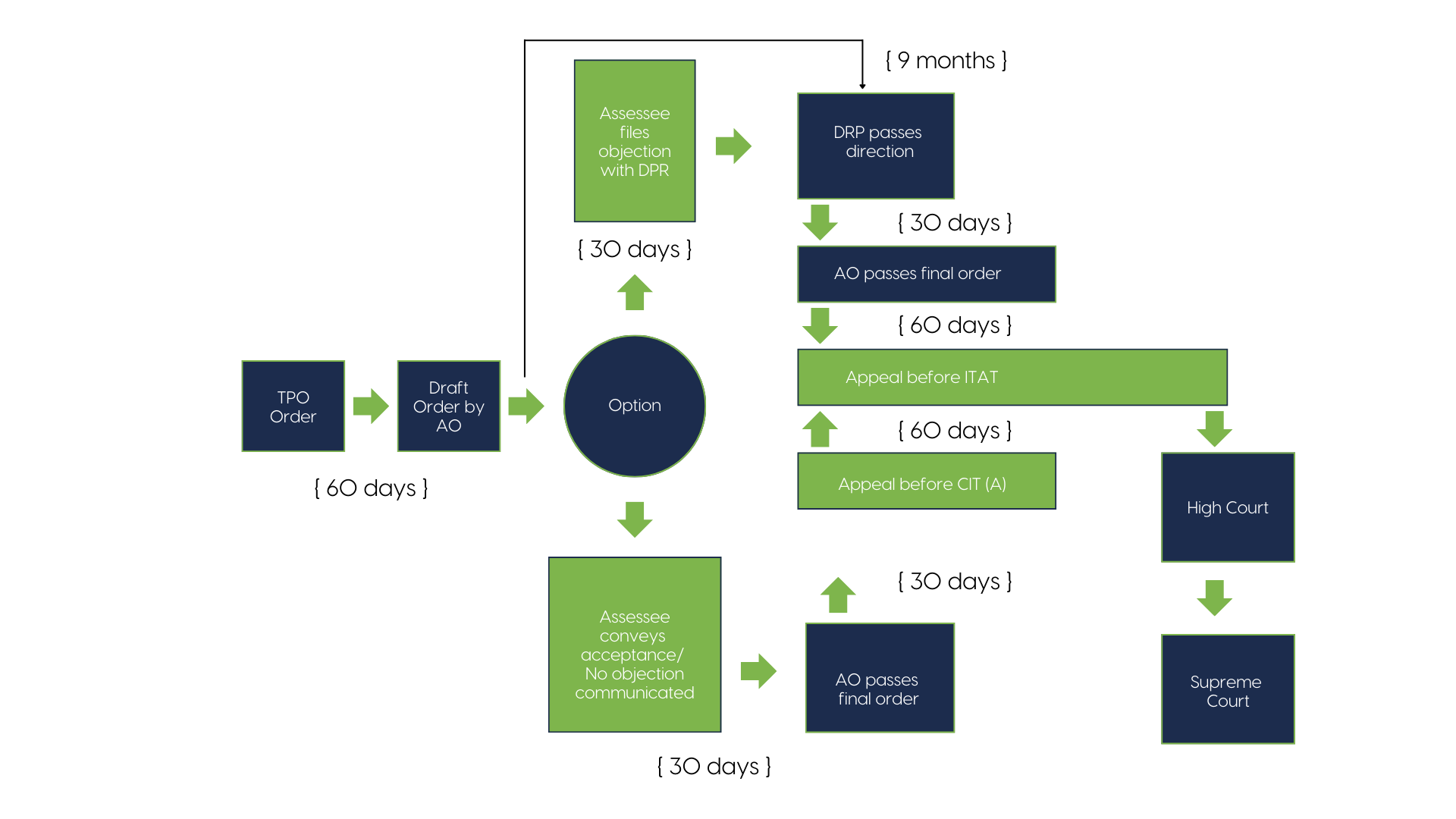

The time limit for issuing directions and passing an order

No opportunity of being heard will be provided to the assessee during this time. If the assessee does not file any objections against the draft order within the prescribed period of 30 days or if he accepts the draft order, then the assessing officer is required to complete his assessment within 1 month from the end of the month where either such 30-day period ends or assessee accepts the draft order, as applicable.

Flow Chart: