Filing Taxes as an NRI: A Guide to Relevant Returns and Forms

Navigating the Indian income tax filing process as a non-resident Indian (NRI) can be intricate due to specific regulations and forms. This comprehensive guide aims to condense crucial information, highlighting the essential returns and forms that NRIs must be familiar with to ensure a seamless tax compliance experience.

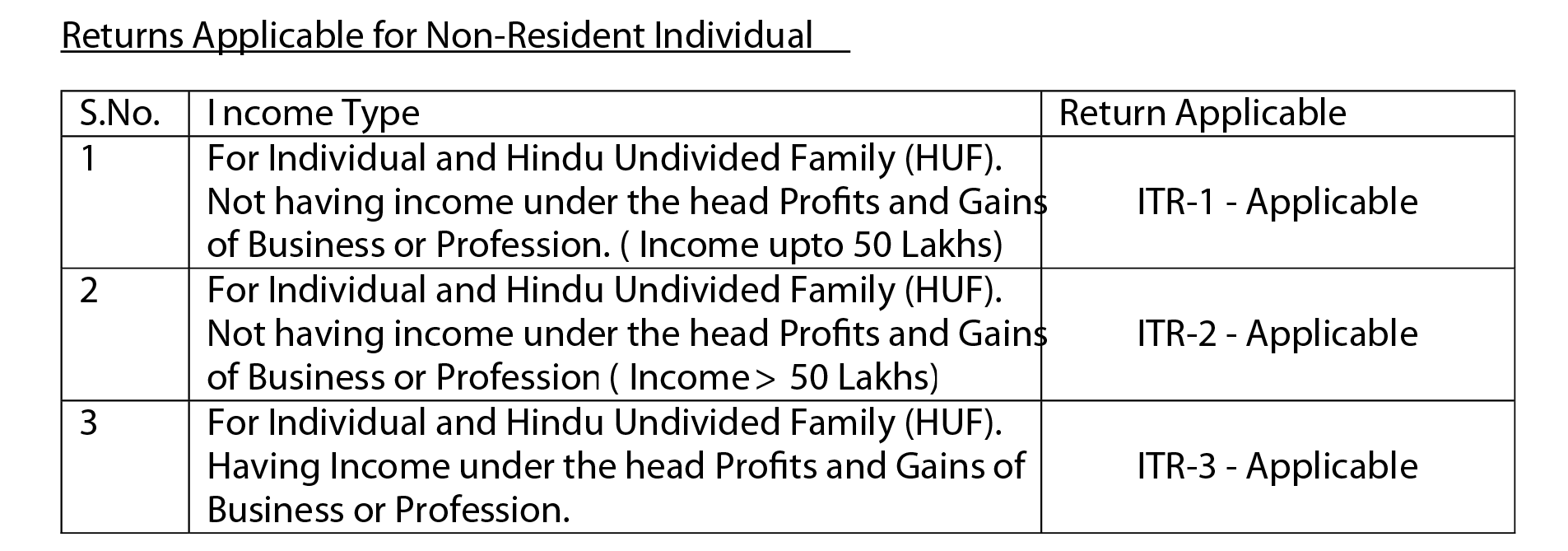

Income Tax Returns for NRIs

The main income tax return forms relevant for NRIs are:

ITR-1 – This is for resident and non-resident individuals having total income up to Rs.50 lakhs from salaries, one house property, interest, family pension, etc. This simplest ITR form cannot be used by NRIs having income from business/profession or capital gains.

ITR-2 – This return form is for individuals and HUFs not having income from business or profession. All types of incomes applicable for NRIs can be reported in this form like rental income, capital gains, foreign assets/incomes, etc. It is applicable for non-resident individuals with income over Rs.50 lakhs.

ITR-3 – This is applicable for NRIs having income under the head “Profits and Gains from Business or Profession”. So any NRI with turnover above the threshold limit (Rs.10 lakhs or Rs.25 lakhs depending on business type) has to file ITR-3 regardless of overall income levels.

The major challenge is to identify which ITR form correctly matches the NRI’s income profile. So they should carefully assess their various income sources before selecting the applicable ITR.

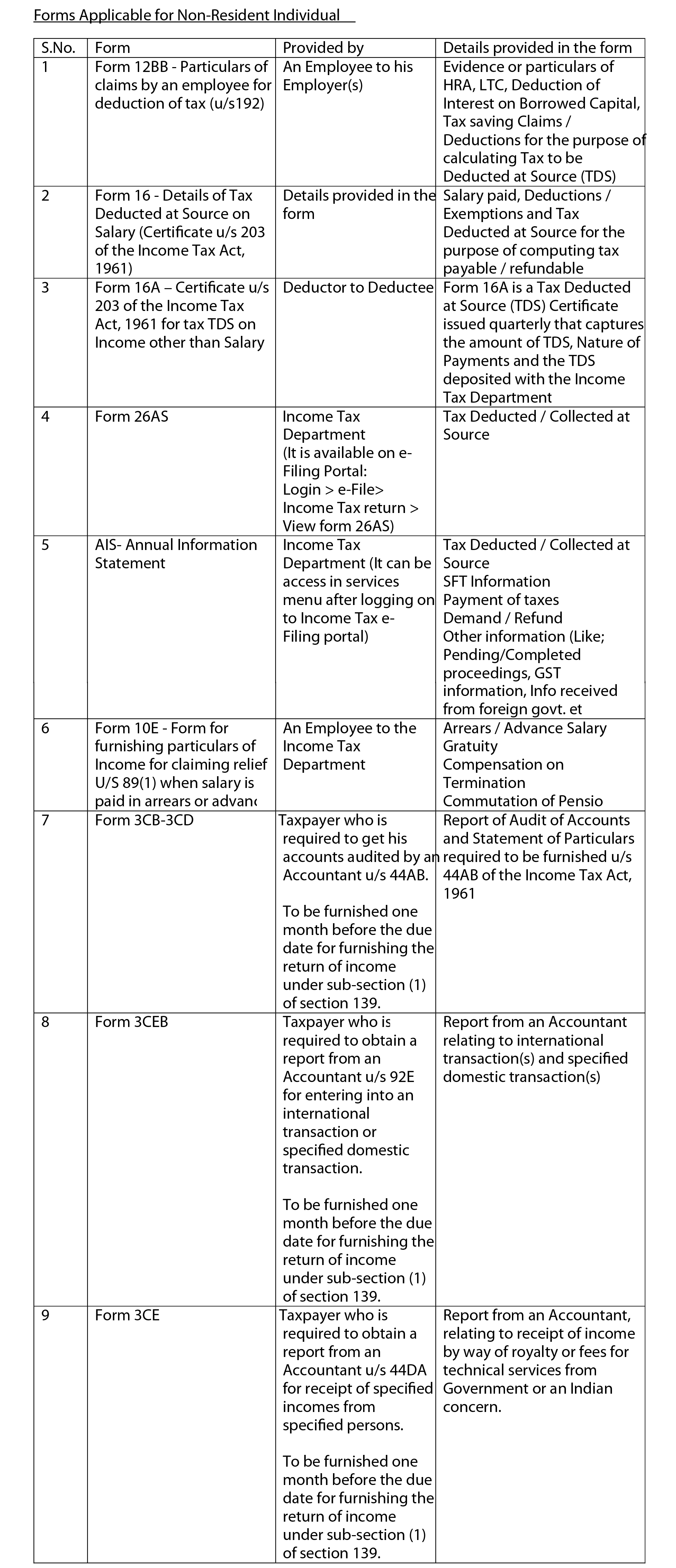

Key Forms to be Furnished by NRIs

Apart from income tax returns, NRIs may also be required to furnish other forms and declarations such as:

- Form 12BB – For providing investment/exemption details to employers for TDS calculations

- Form 16/16A – Tax deduction certificate from employer/clients to track TDS credits

- Form 26AS – Consolidated annual tax statement from IT Department

- Form 10E – For income tax relief on salary arrears/advance

- AIS – Annual Information Statement received via email from IT Dept

- Form 3CB-3CD: Tax audit report from chartered accountant

- Form 3CEB: CA certificate for international transactions

- Form 3CE: CA certificate regarding royalty/FTS income

The deadline for submitting audit forms (No.6, 7 & 8 mentioned above) is one month prior to the due date for filing ITR. Failure to comply with this requirement may result in penalties ranging from Rs.1-2 lakhs, depending on the duration of the default.

Navigating the complexities of NRI tax filing can be daunting. Therefore, staying informed about the latest regulations and seeking professional expertise can prove beneficial in optimizing tax liability.