New Labour Law Codes and its Implications

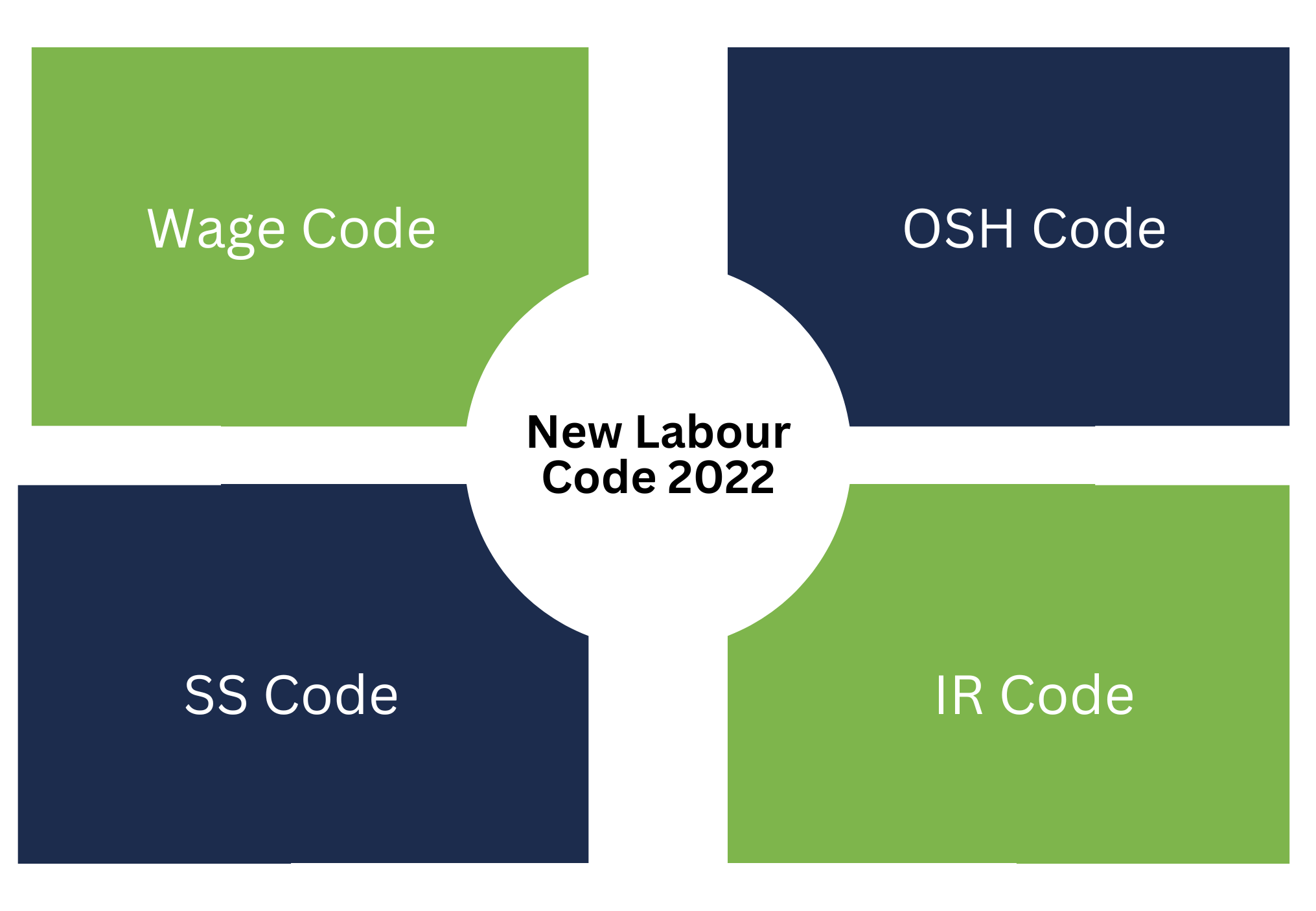

The recently enacted Labour Code of 2022 in India is set to usher in significant modifications to the current compensation framework and various employment benefits. The Indian government has streamlined 29 national labor laws into four key labor codes:

- The Code of Wages 2019

- The Industrial Relations Code 2020

- The Code of Social Security 2020

- The Occupational Safety, Health and Working Conditions Code 2020

While these four codes have been enacted, they are currently pending effective implementation dates.

Key Provisions of New Labour Code 2022 and the Implications to the Employers:

The Wage Code:

The new wage code consolidates regulations pertaining to wages, bonuses, and associated matters. It introduces a standardized definition of ‘wages,’ encompassing an employee’s basic pay, dearness allowance, and retaining allowance (if applicable), with a minimum requirement of 50% of the total cost to the company. This could lead to a reduction in take-home salary in certain instances, as it may positively impact provident fund contributions and other social security benefits, which are calculated based on an employee’s basic pay or wages. Furthermore, the Act mandates the establishment of minimum wages, potentially imposing an additional financial burden on employers.

The OSH Code:

The OSH Code applies to workers, i.e., persons not engaged in managerial or administrative role, or supervisory role with a monthly wage exceeding INR 18,000. However, the provisions relating to health and working conditions apply to all employees.

The Code provides a national database for interstate migrant workers to collect, compile and analyse occupational safety and health statistics. The OSH Code also requires mandatory health checkups in establishments. Further, consent is required from the workers for overtime work for which they shall be remunerated twice the wages.

The SS Code:

The SS code provides for a separate social security fund for the unorganized workers. Under the SS Code, the Employees’ State Insurance benefits shall be extended to all industries involved in hazardous processes, i.e., irrespective of the number of employees engaged by such industries. Also, the gratuity will have to be paid on a proportionate basis to the employees employed on fixed-term contracts. The increased focus on the social security provisions for workers will ensure the optimisation of the labour force and the availability of skilled labour for employers.

The IR Code:

The IR Code looks to optimise the ease of doing business with various changes such as, the increase in threshold limit from 100 to 300 workers for the applicability of standing orders to industrial establishments. The threshold of workers for permission for layoff, retrenchment and closure in industrial establishments is increased to 300 workers. Workers’ disputes are to be resolved within 1 year by the Industrial Tribunals which will have 2 members to facilitate faster disposal of cases. Mass casual leave by more than 50% of workers on a day and strikes can be done only after adhering to certain requirements such as notice, etc.

The code emphasizes on recognition of trade unions in industrial establishments for collective bargaining. Under the IR Code, where only one trade union of workers is functioning in an industrial establishment, then the employer shall, subject to such criteria as may be prescribed, recognise such trade union as the sole negotiating union of the workers. If more than one trade union of workers functioning in an industrial establishment, then the trade union having support of 51% or more workers shall be recognised by the employer as the sole negotiating union of the workers. However, in industrial establishments in which no trade union has a membership of more than 51%, a negotiating council of trade unions shall be constituted for the purpose of collective bargaining.

Further, as per the IR Code, at the time of retrenchment of workers, the employer should contribute to the reskilling fund set up for the reskilling of retrenched workers.

The Code also restricts the engagement of contract labour/third party employees in certain core activities, which will require the organizations to review their arrangements for the engagement of the workforce.

| Objective and Compliances | Regulate the employment of contract labour in certain establishments | •Registration of Establishment by Principal Employer •Maintenance of Registers(like muster roll, wage register) •Filing of Half yearly and annual returns by Principal employer •Display of abstracts of the Act on Notice board in English & local language | ||||||||

| Applicability | •Establishment where 20 or more workman are employed in a particular year as contract labour | |||||||||

| Key Compliances | Statutory obligations to be incorporated for contractors as Principal employer | •Contractors should be engaged in purpose as stated in the Registration certificate along with the purpose of work provided. •Contract labour shouldn’t be engaged for main activities of establishment but for ancillary activities. | ||||||||

| Statutory Filings | Due dates and Forms | •Form I – Application for Registration under CLRA •Form V – Certificate from Employer – as and when event occurs •Form VIB- Notice of commencement or completion of contract work by Principal Employer – as and when event occurs •Form XXV –Annual return of Principal employer under CLRA – before 31st January every year | ||||||||

| Registers to be Maintained | •Form XII – Register of Contractors •Form XVI- Muster roll •Form 13- Register of wages •Form XIII – Register of workmen employed •Form XXVI- Register of employment •Form XXIII- Register of overtime |

| Objective and Compliances | Regulation of PF, Pension fund and deposit linked insurance for employees | •Calculation and deposit of PF within prescribed statutory limit •Filing of statutory returns •PF transfers, loan against PF, pension etc | ||||||||||

| Applicability | •Every establishment having 20 or more employees •Voluntary registration for less than 20 employees is also notified under the Act | |||||||||||

| Key Compliances | As an Employer and as a Principal employer | •Salary calculation shouldn’t be less than Minimum wages prescribed for PF Calculation •Contractors deployed through contract labour should have a check by a Principal employer •Option of Voluntary Provident fund •Principal employer responsible for default of contractors | ||||||||||

| Statutory Filings | Monthly Returns | •Monthly ECR to be filed before 15th of every month •International worker return to be filed before 15th of every month | ||||||||||

| Registers to be Maintained | As an Employer | •Eligibility Register •Form 2- Nomination and declaration form by new employee |

| Objective and Compliances | •Compulsory notifications of all vacancies in private sector establishments | ||||||

| Applicability | •Notification of vacancies within 15 days •Display of Abstracts of the Act in English and local language | ||||||

| Key Compliances | •Notification of vacancies within 15 days •Display of Abstracts of the Act in English and local language | ||||||

| Statutory Filings | Quarterly Returns | •Filing of quarterly return within 30 days of end of quarter. Quarter ending period 31st March, 30th June,30th September, 31st December |

| Objective and Compliances | •Compulsory insurance of specified employees •Medical benefits, maternity benefits, dependants benefits etc | ||||||

| Applicability | To all factories and establishments | •In which 10 or more are employed | |||||

| Key Compliances | As an Employer and Principal Employer | •Principal Employer responsible for default of contractors | |||||

| Statutory Filings | Monthly Returns & Annual returns | •Before 21st of every month •Form 01-A –before 31st Jan every year | |||||

| Registers to be maintained | •Attendance and wage registers •Register of payments/contributions – Form 6 •Accident register – form 11 •Employee register –Form 7 |

| Objective and Compliances | •Payment of bonus to person employed in establishment on the basis of profits or basis of production | |||||||

| Applicability | Applicable for Establishment and Factory | •In which 20 or more persons are employed in a year drawing remuneration of wages 21000/- per month | ||||||

| Key Compliances | •Computation of gross profits and bonus payable as per the computation •Payment of bonus within statutory time limit | |||||||

| Statutory Filings | Annual Filings | •Form D- Before 31st Jan every year | ||||||

| Registers to be maintained | •Form A – Allowance of surplus in the format specified •Form B –Set on and Set off of allowable surplus •Form C – Amount of bonus due to each employee |

| Objective and Compliances | •It primarily deals with safety measures, welfare measures, working hours etc | ||||||||

| Applicability | Applicable for Establishment and Factory | •In which 10 or more persons are employed in a year | |||||||

| Key Compliances | •It provides the safety measures, working hours, annual leaves with wages, weekly holidays, weekly hours, overtime , crèches etc | ||||||||

| Statutory Filings | Annual Filings | •Before 31st January every year | |||||||

| Registers to be maintained | •Form 15 and 16- Register of leave with wages •Form 20- Accident register •Form 29- Muster roll •Form 13- Register of workers •Form 10- Register of compensatory holidays |

| Objective and Compliances | •It provides full and healthy maintenance of woman and her child while she is not working | ||||||

| Applicability | As an Employer and Principal Employer | •For all women employed in Factories, Establishments of 10 or more | |||||

| Key Compliances | •Claim of benefits •Leave for illness arising out of pregnancy •Grant of maternity leaves with benefits | ||||||

| Statutory Filings | Annual Return | •Before 31st January every year | |||||

| Registers to be maintained | •Form 22-Maternity benefit register •Form A – Muster roll •Form 19- Maternity form benefit |

| Objective and Compliances | •TO provide working conditions of work and employment in shops and establishments | ||||||||||

| Applicability | •Applicable to all establishments/commercial establishments | ||||||||||

| Key Compliances | •Need to check on working hours,overtime spent, rate of overtime wages •Maintenance of registers in prescribed format by employers •Display of license and abstracts of the act on notice board of the company | ||||||||||

| Statutory Filings | |||||||||||

| Registers to be maintained | •Form A- Application for registration/renewal •Form C- Certificate of registration/Register of employees •Form F –Register of leave with wages •Form H – Leave with wages book •Form J – Leave details •Form P – Notice of display •Form Q – Appointment letter •Form R – Permission to allow women employees to work after 8PM •Form N – Register of employment and overtime payment •Form T – Combined Muster roll with wage register •Form U- Combined Annual return |

| Objective and Compliances | •To protect and prevent women from any sexual harassment in their places of work and provide them to lead healthy and professional safe life | ||||||||||

| Applicability | •It is applicable to all women workmen employed by employer at his workplace. | ||||||||||

| Key Compliances | •Constitution of Internal Complaints Committee (ICC) with majority constitution of women and an external nominee who is familiar with issues of sexual harassment •Conduct of awareness workshops at regular intervals •Display of penal consequences of sexual harassment if any | ||||||||||

| Statutory Filings | Annual Returns | •To be filed before 31st January every year | |||||||||

| Other Points to be noted | •Documents to be maintained as per the sequence of events if any •Non –compliance shall be penalized with a fine of Rs.50,000 and can be extended for cancellation of business license incase of repeated non-compliance. •Display of Notice of Sexual Harassment policy on Notice board with details of Name and contact number of ICC Members |

| Objective and Compliances | •To regulate employment of inter – state migrant workmen & provide for their conditions of services | |||||||||||||||||

| Applicability | Employer/Principal Employer | •It is applicable to all establishments/contractors employing 5 or more Inter-State migrant workmen on any day in the financial year. | ||||||||||||||||

| Key Compliances | •Registration under the said act •License of contractors, welfare and other facilities to inter-state workmen etc | |||||||||||||||||

| Statutory Filings | Half yearly and Annual Returns | •Form XXIII – Half yearly return – before 30th July and 30th Jan on details of workers engaged and wages paid and other amenities provided | ||||||||||||||||

| Registers to be maintained | •Principal Employer to maintain register of contractors –Form XII •Principal Employer and contractor to maintain registers – Form XIII •Termination Certificate – XIV •Muster Roll – XVII and XVIII •Register of Overtime – XXII •Display of Abstracts on Notice board |

| Objective and Compliances | •To provide for the grant of national and festival holidays to employees | ||||||||||

| Applicability | Employer/Principal Employer | •It is applicable to all establishments | |||||||||

| Key Compliances | •Mandatory National and Festival Holidays •Compensatory Holiday when employee works on any holiday | ||||||||||

| Statutory Filings | Annual Returns | •To be filed before 31st December every year | |||||||||

| Other Points to be noted | •Display of list of holidays on Notice board of the company for a particular calendar year •Entitlement of twice the wages and substituted holiday within six months to such employee who worked on any holiday. |

| Objective and Compliances | •It is a social security measures to employees who has rendered continuous service | ||||||

| Applicability | Employer | •It is applicable to all establishments having 10 or more employees | |||||

| Key Compliances | •It is applicable for employees who rendered continuous services for five years or more •Registration of establishment •Payment of Gratuity | ||||||

| Statutory Filings | Annual Returns | •To be filed before 31st January every year | |||||

| Registers to be maintained | •Display of abstract of the Act •Form F – Nomination •Form C- Notice of Closure |

| Objective and Compliances | •It is a social security measures to employees and contribution is done by both employee and employer | |||||||||

| Applicability | Employer | •It is applicable to all establishments having 5 or more employees | ||||||||

| Key Compliances | •It is applicable for employees who rendered continuous services for five years or more •Registration of establishment •Payment of Gratuity | |||||||||

| Statutory Filings | Annual Returns | •To be filed before 15th January/15th July every year | ||||||||

| Registers to be maintained | •Form A – Register of wages •Form E – Register of Unclaimed wages |

| Objective and Compliances | •To regulate payment of wages for employees | |

| Applicability | Employer | •It is applicable to all establishments |

| Key Compliances | •Payment of wages within 7 days/10 days of succeeding month •Display of Abstracts of the Act •Display of wages paid date on notice board of the company |

|

| Statutory Filings | Annual Returns | To be filed before 31st January every year |

| Registers to be maintained | •Form B – Register of wages •Form II – Register of deductions for damage or loss •Form C – Register of Fines •Form III – Register of advances •Form XI – Register of attendance |