NRI Income Tax: A Comprehensive Guide for Non-Resident Indians

The classification of residential status plays a crucial role in determining the income tax liabilities of Non-Resident Indians (NRIs) in India. The tax implications vary depending on whether an individual is categorized as a ‘resident’ or an ‘NRI.’ Residents are subject to taxation on their global income in India, whereas NRIs are only taxed on income earned or accrued within the country.

However, significant changes were introduced by the Finance Act of 2020 to the residency provisions, particularly impacting Indian Citizens/Persons of Indian Origin visiting India. This amendment introduced the concept of ‘Resident but Not Ordinarily Resident’ (RNOR), contingent upon specific conditions:

Income Threshold: Total income, excluding foreign income, must be Rs 15 lakh or more.

Stay Duration: The individual should have stayed in India for more than 120 days but less than 182 days in the previous year.

Four-Year Criterion: The person must have stayed in India for 365 days or more in the four years preceding the previous year.

Stay Duration: The individual should have stayed in India for more than 120 days but less than 182 days in the previous year.

Four-Year Criterion: The person must have stayed in India for 365 days or more in the four years preceding the previous year.

Prior to this amendment, such individuals were categorized as non-residents. The change to RNOR status may result in the loss of benefits under Double Taxation Avoidance Agreements (DTAA), an expanded scope of total income for taxability, and the forfeiture of various exemptions.

It’s crucial to note that under this amendment, an individual staying for more than 182 days is deemed a resident, irrespective of the income level in the previous year. This modification has far-reaching implications, requiring careful consideration of the potential loss of DTAA benefits, increased taxable income scope, and the elimination of previously granted exemptions.

Deemed Residency Status Introduced in Finance Act 2020

The Finance Act of 2020 ushered in a significant paradigm shift with the introduction of the ‘Deemed Residency’ status. Under this provision, individuals who are citizens of India and earn more than Rs 15 lakh from sources within the country will be considered residents of India. This classification applies specifically to those individuals who are not obligated to pay taxes in any other nation.

Effective from the financial year 2020-21, individuals falling under the category of deemed residents will be designated as “Resident but Not Ordinarily Resident” (RNOR). This legislative amendment was implemented to address the tax implications of Indian citizens whose income is not subject to taxation in any foreign jurisdiction.

Example 1:

Napoleon, an American tourist, embarks on his first journey to India on June 17, 2023, creating a scenario for assessing his residential status during the subsequent assessment year.

Residential Status Overview:

To ascertain Napoleon’s residential status for the assessment year 2024-25, we delve into his presence in India during the preceding years, a crucial determinant according to tax regulations.

Previous Years Analysis:

- 2023-24: Napoleon’s stay in India during this period spans 105 days, failing to meet the basic conditions for residency.

- 2022-23: Nil presence in India.

- 2021-22, 2020-21, 2019-20: Absence in India during these years.

Residential Status Determination:

Given his limited stay in India in the previous year 2023-24, Napoleon falls under the non-resident category for the assessment year 2024-25. The foundational residency conditions remain unmet.

Consideration for Indian Origin and Income:

Even if Napoleon is a person of Indian origin and earns INR 16 lakhs from Indian sources, the non-resident status persists. To transition to a resident but not ordinarily resident, a minimum stay of 120 days in the previous year and 365 days in the four immediately preceding years is required. As Napoleon’s stay in India during the P.Y. 2023-24 falls short of the 120-day threshold, his non-resident status for A.Y. 2024-25 remains unchanged.

Conclusion:

In conclusion, Napoleon’s residential status for the assessment year 2024-25 remains non-resident, as the criteria for residency, including the requisite stay duration, are not met.

Example 2:

Miss Vaishnavi made a payment of 6000 USD to Mr. Kailesh, a seasoned management consultant practicing in Texas, specializing in project financing. Notably, Mr. Kailesh is a nonresident, and the consultancy services pertain to a project in India.

Taxability of Non-Resident's Income:

According to taxation norms, a non-resident individual is liable for taxation in India only if the income is received outside India and accrues, arises, or is deemed to accrue or arise within the Indian territory.

Deemed Accrual of Income in India:

Under section 9, income deemed to accrue or arise in India encompasses various categories, including fees for technical services. This category broadly includes compensation for providing managerial, technical, or consultancy services. Consequently, the payment made to a management consultant for project financing falls under the umbrella of “fees for technical services.”

Applicability to the Case:

In the present scenario, given that the consultancy services were utilized for a project situated in India, the payment received by Mr. Kailesh, despite being a non-resident located in Texas, is subject to taxation in India. This is because the income is deemed to accrue or arise within the Indian jurisdiction.

Conclusion:

In conclusion, the payment made to Mr. Kailesh is chargeable to tax in India as per the provisions outlined in section 9. The geographical location of the recipient does not exempt the income from taxation when the services are utilized within the Indian territory. The taxation framework ensures that income generated from services contributing to Indian projects is appropriately subject to taxation in India, even if the recipient is a non-resident.

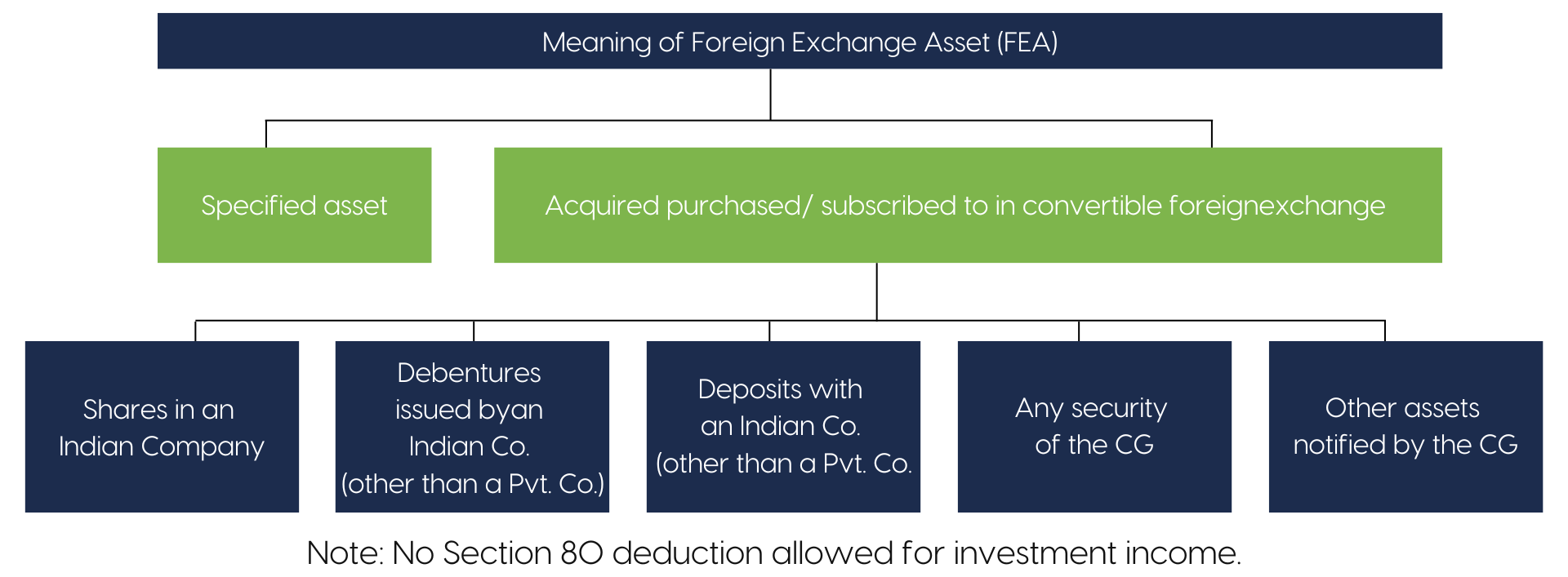

Special Provisions for Investment Income

Taxation for NRIs on Certain Indian Assets

When Non-Resident Indians (NRIs) choose to invest in specific Indian assets, they are subject to a tax rate of 20% on the income generated from these investments.

Exemption for NRIs with Only Special Investment Income

In cases where an NRI has earned income exclusively from special investments during the financial year and Tax Deducted at Source (TDS) has already been deducted, filing an Income Tax Return (ITR) is not mandatory for such individuals.

Qualified Investments for Special Treatment

The special treatment applies to income originating from Indian assets acquired in foreign currency. This encompasses a range of investments that are eligible for the unique taxation rate of 20% on the generated income.

Exemption for NRIs with Only Special Investment Income

In cases where an NRI has earned income exclusively from special investments during the financial year and Tax Deducted at Source (TDS) has already been deducted, filing an Income Tax Return (ITR) is not mandatory for such individuals.

Qualified Investments for Special Treatment

The special treatment applies to income originating from Indian assets acquired in foreign currency. This encompasses a range of investments that are eligible for the unique taxation rate of 20% on the generated income.

NOTE:

Please note that no deductions under Section 80 are applicable when calculating investment income.

A special provision concerning Long-Term Capital Gains (LTCG) stipulates that, in the case of gains arising from the sale or transfer of foreign assets, the benefits of indexation and deductions under Section 80 are not applicable.

However, there exists an opportunity for exemption under Section 115F if the profit generated is reinvested into specific categories of assets referred to as “Special Assets.” These include:

A special provision concerning Long-Term Capital Gains (LTCG) stipulates that, in the case of gains arising from the sale or transfer of foreign assets, the benefits of indexation and deductions under Section 80 are not applicable.

However, there exists an opportunity for exemption under Section 115F if the profit generated is reinvested into specific categories of assets referred to as “Special Assets.” These include:

- Shares of an Indian company

- Debentures of an Indian public company

- Deposits with banks and Indian public companies

- Central Government securities

- National Savings Certificate (NSC) VI and VII issues

By reinvesting the profit into any of these designated Special Assets, one can qualify for an exemption, offering a strategic approach to managing Long-Term Capital Gains in the context of foreign asset transactions.