SIGNIFICANT BENEFICIAL OWNER (SBO): A Comprehensive Overview

Governing Laws:

- Section 90 of the Companies Act, 2013

- Companies (Significant Beneficial Owners) Rules 2018

- Companies (Significant Beneficial Owners) Second Amendment Rules, 2019

Overview of Section 90:

- Section 90 and associated Rules were notified on June 13, 2018.

- Individuals must file a Declaration of SBO (Form BEN-1) within 90 days of Rule commencement (by September 12, 2018).

- Companies must file the return of SBO (Form BEN-2) within 30 days of Form BEN-1 declaration (by October 12, 2018).

- E-form BEN-2 deployment on July 1, 2019, with filing deadline on July 31, 2019.

Criteria for Significant Beneficial Owner (SBO) under Section 90:

An individual, acting alone or together, directly or indirectly, must meet one of the following criteria in a reporting company:

- Holds not less than 10% of shares.

- Holds not less than 10% of voting rights.

- Has the right to receive or participate in not less than 10% of total distributable dividends.

- Has the right to exercise or actually exercises significant influence or control (at least 20% of total share capital or business decisions).

Direct Holding:

- Individual’s name appears in the Register of Members.

- Declaration in Form MGT-5 must be made to the reporting company.

Indirect Holding:

- Individual’s name is not in the Register of Members.

- Criteria for indirect holding include:

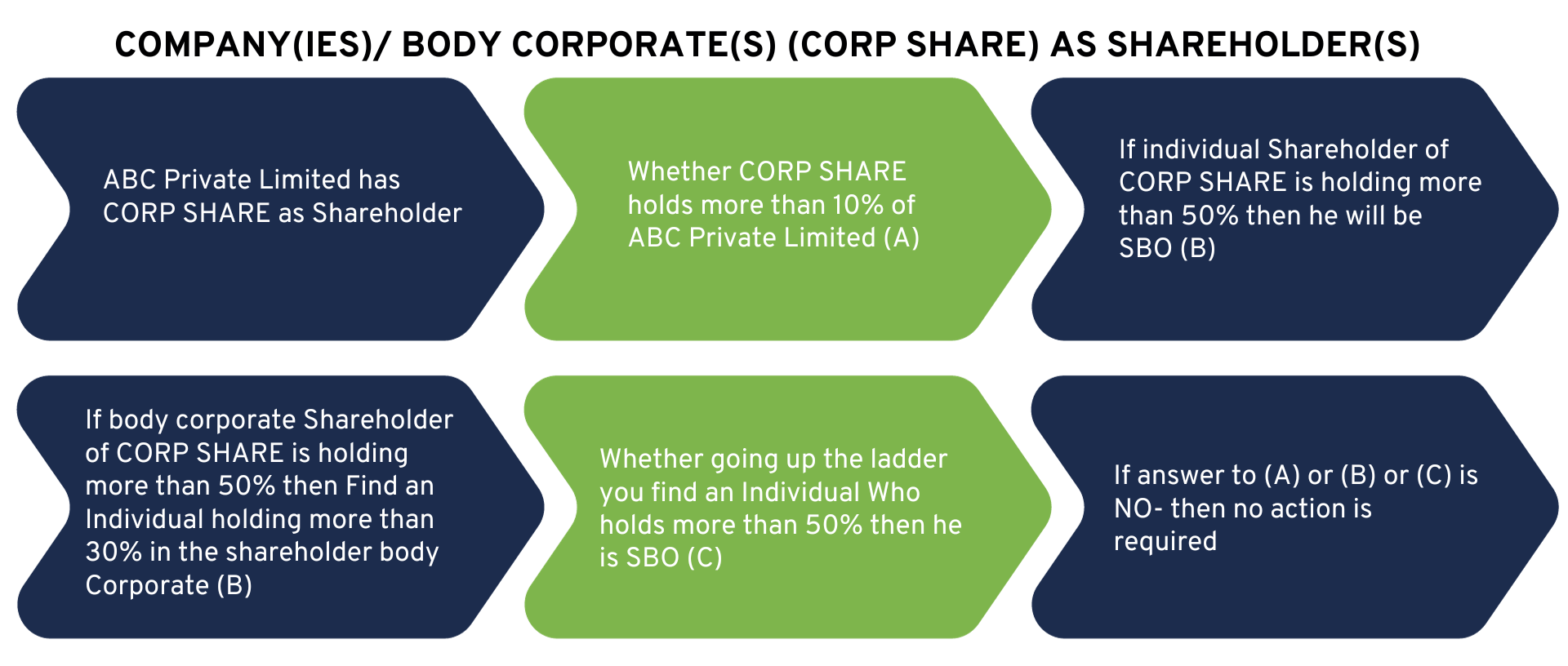

- Holding majority stake in a corporate member.

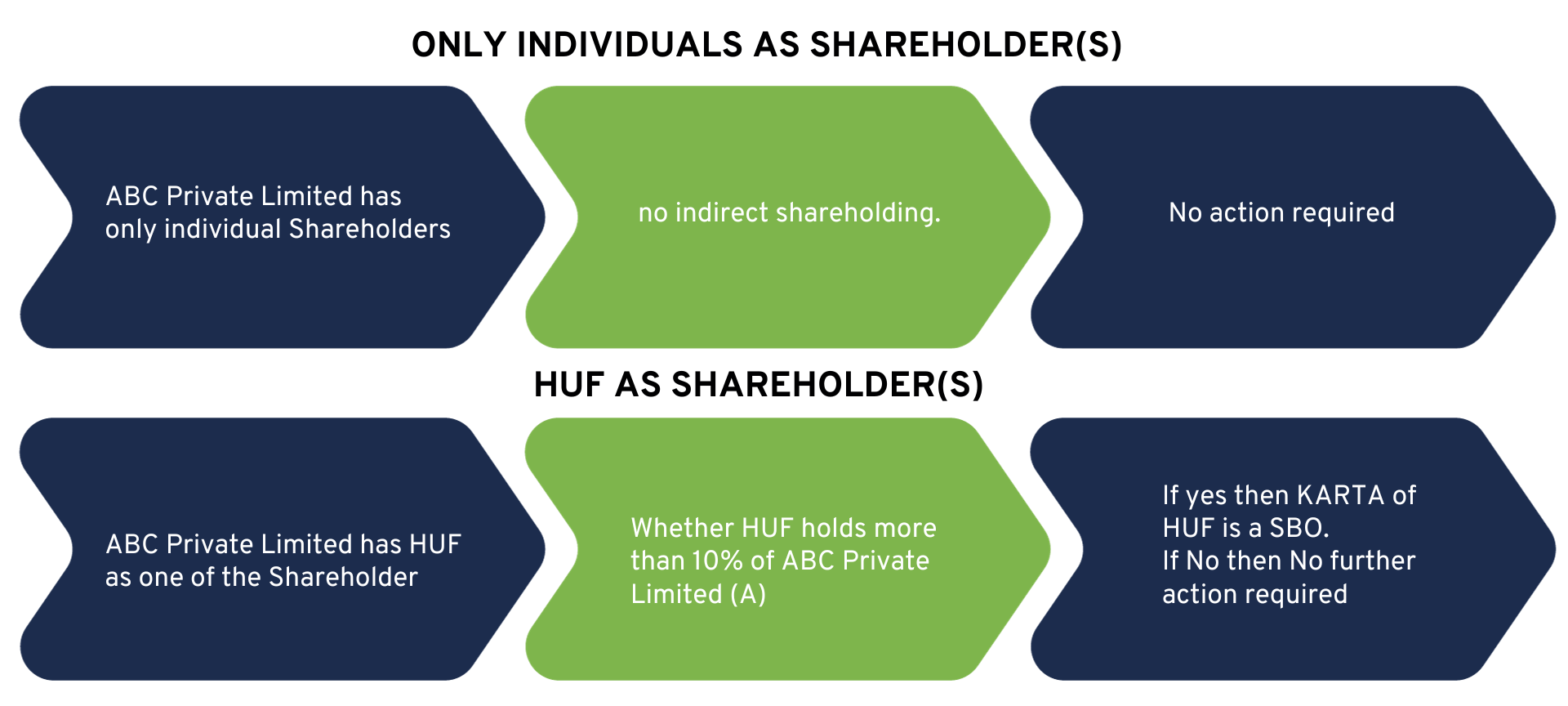

- Being the Karta of a Hindu Undivided Family.

- Being a partner or holding majority stake in a partner entity for partnership members.

- Being a trustee, beneficiary, or author/settlor for trust members.

- Holding specific positions for Pooled Investment Vehicle members.

2. Hindu Undivided Family (HUF) Structure:

If the Member of the Reporting Company is a Hindu Undivided Family (HUF) represented by its Karta, the individual serving as the Karta of the HUF falls under the ambit of Significant Beneficial Owner (SBO).

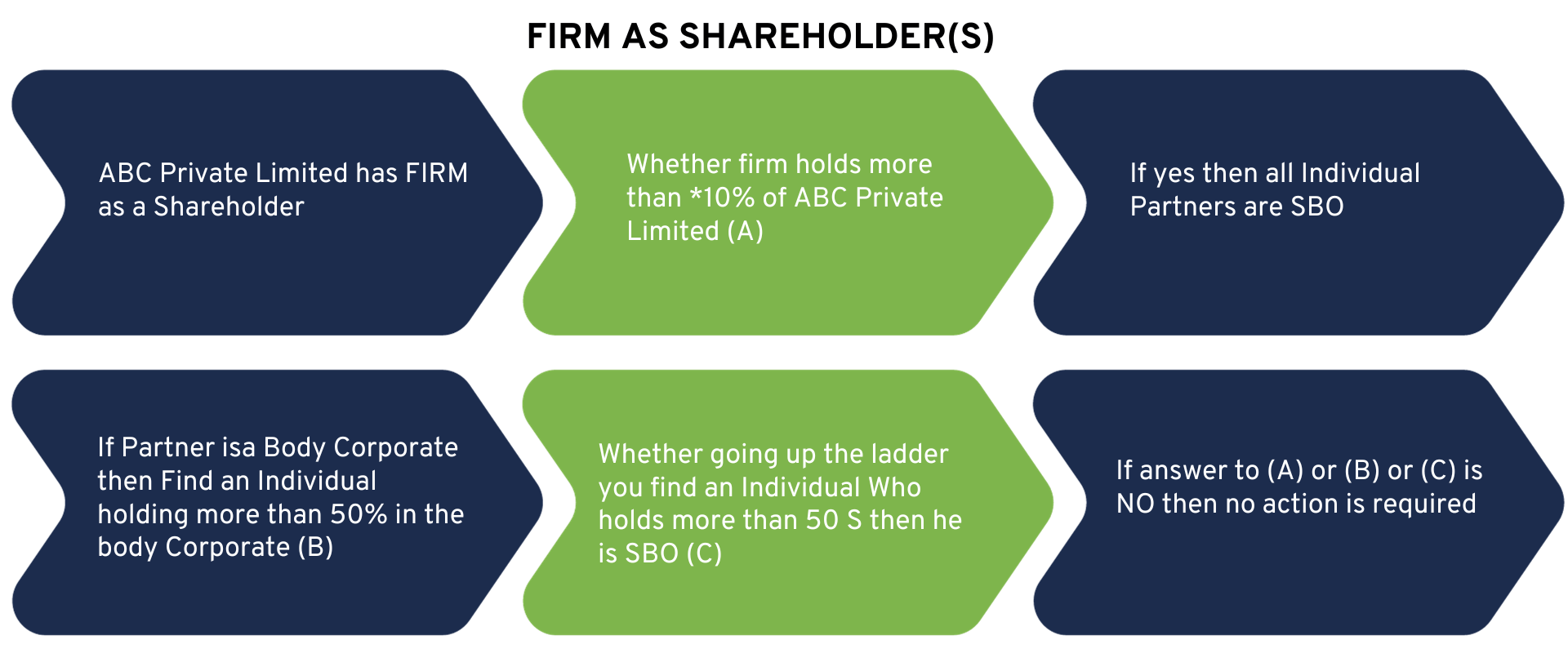

3. Partnership Entity Involvement:

In scenarios where the Member of the Reporting Company is a Partnership Entity, the individual is considered an SBO if they:

- Are a partner in the partnership.

- Hold a majority stake in the body corporate, which is a partner within the partnership entity.

- Possess a majority stake in the ultimate holding company of the body corporate, which is a partner within the partnership entity.

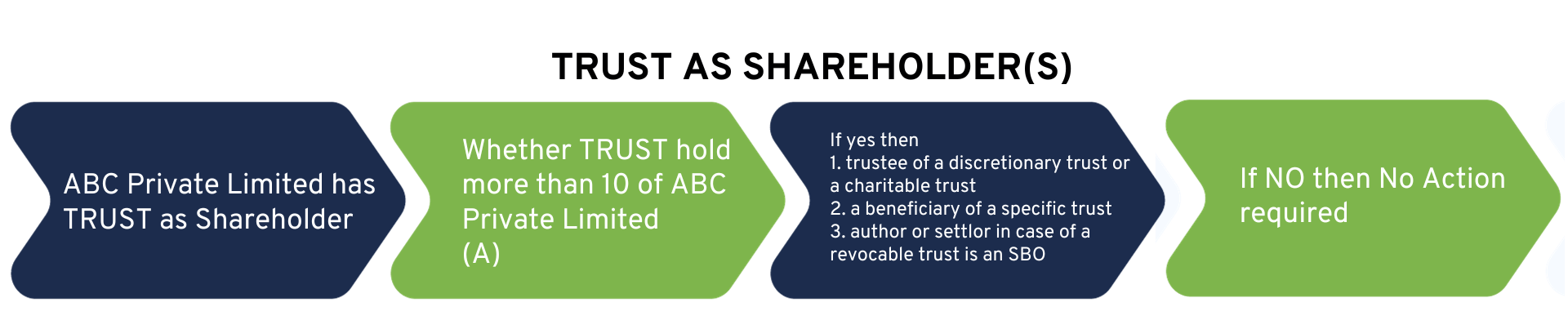

4. Trust Structure Considerations:

For cases where the Member of the Reporting Company is a Trust, the individual is classified as an SBO based on their role in the trust:

- If the individual is a trustee, in the case of a Discretionary Trust or a Charitable Trust.

- If the individual is a beneficiary, in the case of a Specific Trust.

- If the individual is the author or settlor, in the case of a Revocable Trust.

These provisions ensure that individuals holding key roles in various organizational structures, such as HUFs, partnership entities, and trusts, are identified and treated as Significant Beneficial Owners in accordance with Section 90 of the Companies Act, 2013.

5. Involvement with Pooled Investment Vehicles:

- A Pooled Investment Vehicle (e.g., Mutual Fund, Venture Capital Fund), or

- An Entity Controlled by the Pooled Investment Vehicle,

- If the individual serves as a General Partner,

- If the individual is designated as an Investment Manager,

- If the individual holds the position of CEO when the Investment Manager of the pooled vehicle is a Body Corporate or a Partnership Entity.

Reporting Company Definition:

A Reporting Company, as per section 2(20) of the Companies Act, 2013, is a company obligated to comply with the provisions of Section 90 and identify Significant Beneficial Owners. This includes causing compliance with the relevant provisions related to SBOs.

Significant Influence Clarification:

PROCEDURAL REQUIREMENTS FOR SIGNIFICANT BENEFICIAL OWNER (SBO) UNDER SECTION 90 & RULES:

Every company is obligated to take necessary measures to identify individuals deemed as Significant Beneficial Owners (SBOs) in relation to the company. The company must then compel these identified individuals to submit a declaration in Form BEN-1 to the reporting Company.

The SBO is required to submit Form BEN-1 within 90 days from the initiation of the Companies (Significant Beneficial Owners) Second Amendment Rules, 2019. Additionally, if an individual attains SBO status subsequently, they must file the Form within 30 days of acquiring such ownership or any relevant changes.

Upon receiving the aforementioned declaration, the reporting company must expeditiously file a return in Form No. BEN-2 with the Registrar within 30 days, accompanied by the requisite fees. Simultaneously, the company is mandated to maintain a comprehensive register of Significant Beneficial Owners (SBO) in Form No. BEN-3.

Without prejudicing the overall procedural framework outlined above, each reporting company must issue notices, specifically in Form No. BEN-4, to any individual (regardless of their membership status within the company) in cases where the company believes or has reasonable cause to believe:

- The individual is a Significant Beneficial Owner (SBO) of the company.

- The individual possesses knowledge of the identity of an SBO or another person likely to have such knowledge.

- The individual has been an SBO of the company at any time during the immediately preceding last three years from the date the notice is issued.

Additionally, should the individual in question not be enlisted as a Significant Beneficial Owner with the company, as stipulated in section 90, they are obligated to provide the necessary details within 30 days upon receiving the notice from the reporting company. Adhering to these procedural measures and utilizing the prescribed forms is essential for companies and Limited Liability Partnerships (LLPs) to guarantee conformity with the regulations delineated in Section 90 and the corresponding rules.

| S.No | Particulars | Company | LLP | Due Date |

|---|---|---|---|---|

| 01 | Declaration by individual | Form BEN-1 | LLP-BEN-1 | Within 30 days of acquiring such significant vebeficial ownership or any chnage therein |

| 02 | Return to the Registrar in respect of declaration under section 90 |

Form BEN-2 | LLP-BEN-2 | 30 days from the date of receipt of such declaraion |

| 03 | Register of significant beneficial owners (SBO) |

Form BEN-3 | LLP-BEN-3 | -- |

| 04 | Notice by the Company | Form BEN-4 | LLP-BEN-4 | -- |