Navigating Taxation: Expert Tips, Essential Precautions, and Key Due Dates

What is Income Tax Return (ITR) ?

Income tax return is the form in which assesses file information about his/her income and tax thereon to Income Tax Department. Various forms are ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7.

Who should file ITR?

ØPerson whose Gross Total Income [before claiming exemption under any section of series 54] exceeds basic exemption limit.

ØCompany or Firm ( Including LLP): Mandatory

ØTrust: If Total Income before exemption u/s 11 exceeds basic exemption limit

ØPolitical Party: If Total Income before exemption u/s 13A exceeds basic exemption limit

ØTrade Unions, Institutions etc: If Total Income before exemption u/s 10 exceeds basic exemption limit

ØResearch Institutes: Mandatory

ØBusiness Trust: Mandatory

ØInvestment Fund: Mandatory

Specific Circumstances:

1. Even if your income falls below the basic exemption limit, it is mandatory to file ITR if you meet any of these conditions:

v If you have deposited a total of Rs. 1 crore or more in one or more current accounts with a bank. However, no such requirement has been specified for deposits made in with post office current accounts.

v If you have deposited more than Rs 50 lakhs in your ‘savings’ bank accounts.

v If you have spent more than Rs 2 lakhs on foreign travel whether for yourself or any other person.

v If the yearly electricity expenditure is more than Rs 1 lakh.

v If your tax is withheld in form of TDS/TCS is more than Rs 25,000. In the case of a senior citizen (above 60 years), this limit is Rs 50,000.

v Your business turnover is more than Rs 60 lakhs.

v Income from your profession is more than Rs 10 lakhs.

2. If you want to claim an income tax refund

3. If you have earned from or have invested in foreign assets during the FY.

4. If you wish to apply for a visa or a loan

5. If you have loss from business/profession or under capital gains head, you will not be allowed to carry them forward to the next years unless you file the return before the due date.

ITR for NRI’s ?

Irrespective of residential status, any individual whose income exceeds Rs 2.5 lakhs is required to file an income tax return in India. The limit is the same for all NRIs. There is no higher threshold limit for senior or super-senior citizens.

Note that for an NRI, income earned or accrued in India is taxable.

There is one more exception for the NRI taxpayers. Unlike the resident Indians, if there is a long-term or short-term capital gain, the non-residents are not eligible to benefit from the basic exemption limit.

Penalties for Non-Filing Income Tax Return?

Non filing of ITR by 31st July will result in a penalty of Rs 5,000. However, if your income is below Rs 5 lakhs, then the penalty be reduced to Rs 1,000.

Points to be considered @ filing of ITR

1. Choose correct Income Tax Form

2. Verify the ITR after E-filing

3. Report all your Incomes

It is mandatory to report the interest income received from savings or fixed deposit accounts. Banks deducts TDS @ rate of 10%, while the assessee earns interest of more than Rs. 10,000. Hence it becomes imperative that you declare the income from interest in order to avoid notices.

Not reporting exempt income: Many people make the mistake of not reporting income exempt from taxes. It is now mandatory to declare income exempt from Income Tax too, such as PPF Interest, gifts, dividends and Long-Term Capital Gains from listed securities in your tax return.

4. Report correct details

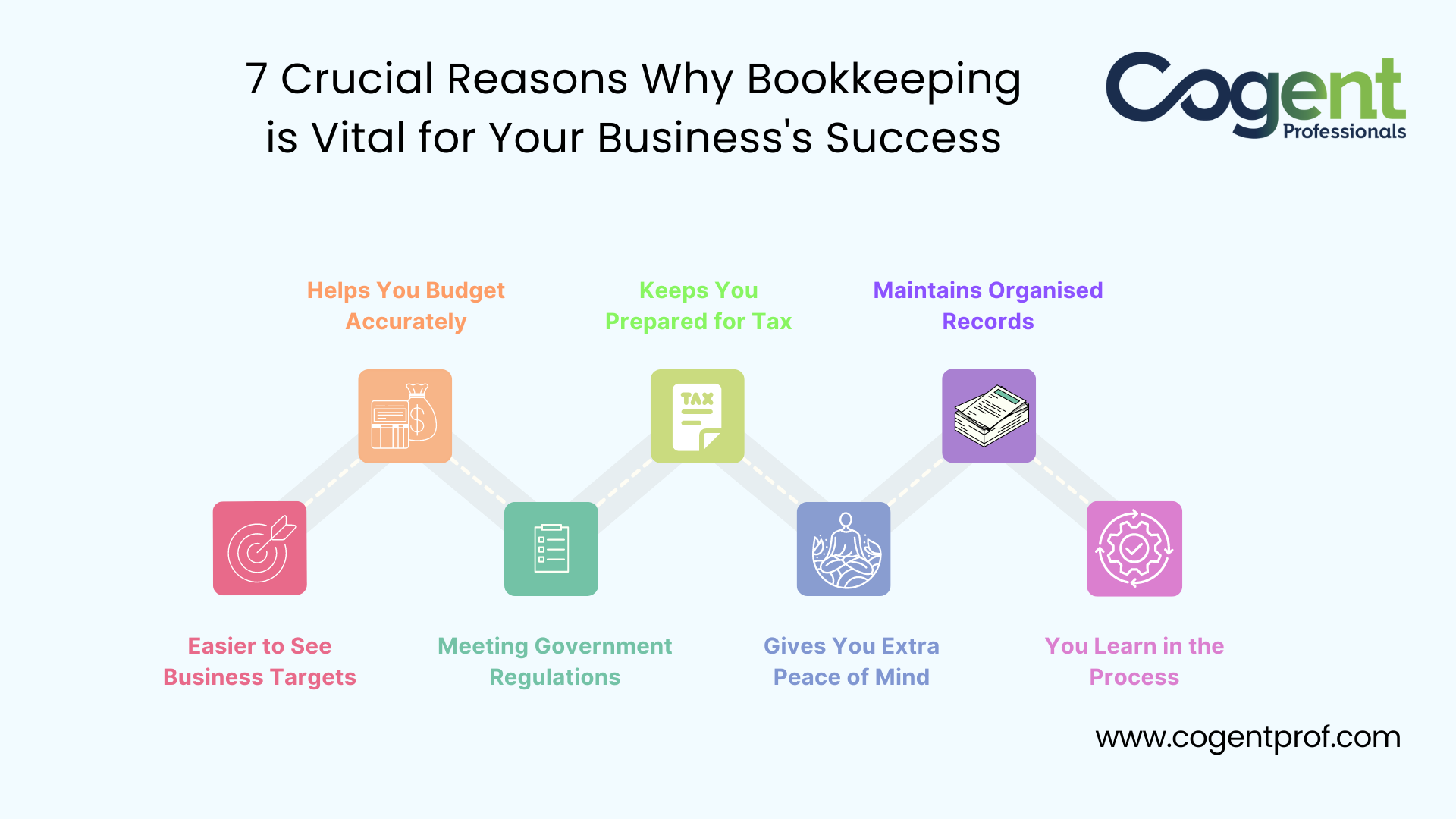

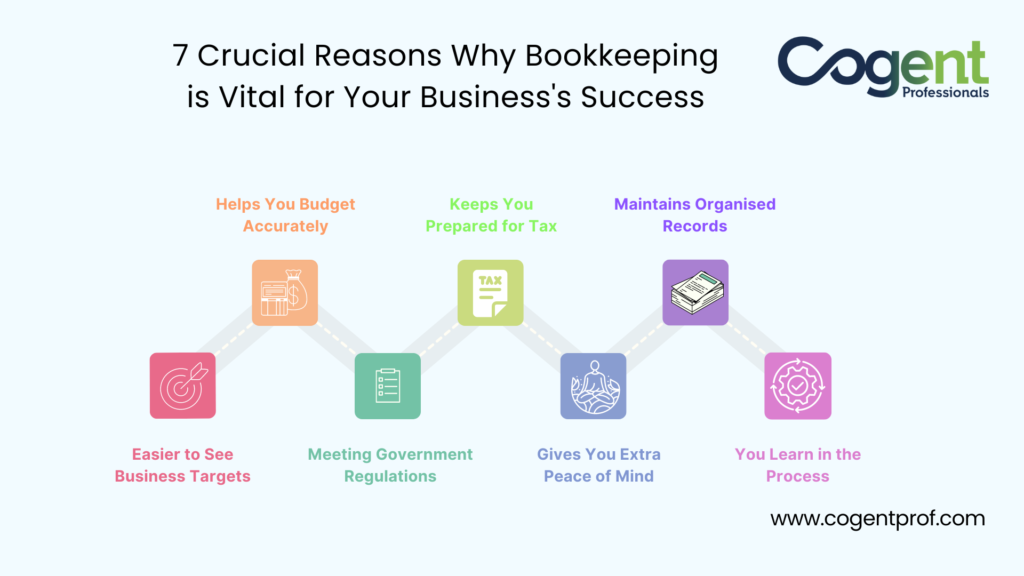

5. Pay all taxes in time

Failing to pay Advance Tax/Self-Assessment Tax: It is mandatory for individual taxpayers to estimate their tax liability and pay advance tax/self-assessment tax before the end of the Financial Year in order to avoid penalty @ 1% per month starting from the end of the relevant quarter. This is required only if your tax liability exceeds Rs. 10,000/- in the Financial Year.

6. Get Organized

If you are an employee and your employer deducts TDS from your salary, the Form 16 that the employer issues to you can be a good starting point since it lists down all details of tax that you have already paid to the Government in the form of Tax Deducted at Source (TDS), your salary components and your Tax Liability.

In case you have not received your Form 16 from your employer, you can look for Form 26AS which lists down the TDS that has been deducted from your salary and been deposited to the Government’s account.

Also, you can keep the following documents handy:

§Pay slips

§CTC Breakup (To claim eligibility under various tax-free income components like HRA, LTA etc)

§TDS Certificates from Bank

§Tax Saving Investment Proofs (To avail deduction under various sections)

§Home and Education Loan & Certificates (if any, in order to avail deductions under Section 80, 80E and 24)

§Bank Statements (required for interest income, gifts received in the relevant Financial Year and dividend income if any)

§HRA Receipts, LTA Expenses and Reimbursement slips

7. Decide how to file

You can file using the Income Tax Department’s public portal online or you can also get Tax Experts to file it for you.

8. Avail Tax Deductions

9. Keep track of TDS. Don’t pay tax twice!

10. Don’t procrastinate and Don’t hurry!

11. And last but not the least, keep the following handy:

ØBank Account details

ØForm 16

ØPAN Number

ØIncome tax e-filing password

ØInvestment Details

ØHome Loan details

ØOther income details

ØAddress

Due dates for filing of return:

|

Assessee |

Due Date |

|

Assessee who is required to furnish transfer pricing report u/s 92E and partner of such firm |

30th Nov of AY |

|

Company |

31st Oct of AY |

|

Audit requirement under Income tax act or any law |

31st Oct of AY |

|

Partner of firm whose accounts are to be audited |

31st Oct of AY |

|

Others |

31st July of AY |

Ready to start investing? Explore your options with us today and save money with our financial strategies and planning services for both businesses and individuals.

Visit us at www.cogentprof.com Contact us via email at [email protected] or give us a call at +91 86961 99999