Registration of an Indian Company by Foreign Entities or Foreign National or Non Resident Indian (NRI’s)

Registration of an Indian Company by Foreign Entities or Foreign National or Non Resident Indian (NRI's)

Why India:

India stands as a prime choice for investment, attracting Non-Resident Indians (NRIs), foreign nationals, and foreign companies. This allure is attributed to its burgeoning economy and abundant resources. Positioned among the world’s swiftest expanding economies, India is poised for substantial growth in the upcoming decades, brimming with ample business prospects. With regulatory reforms and a welcoming atmosphere for investors, foreign investments into India have reached unprecedented levels, with expectations of further ascent.

In this context, we look at the process and procedure for a NRI or Foreign National or Foreign Company to invest or start, manage and grow a business in India.

The Government has always tried to make it easy for not only Indian residents but also for the Non Resident Indians, Foreign Entities and Foreign Nationals. The Ministry of Commerce and Industry created the Foreign Investment Promotion Board to bypass all the difficulties of doing business in India and ensure smooth sailing to all potential foreign investors.

Types of Entities for Registration of Foreign Companies in India

Before registering a foreign company in India, it’s essential to understand the different types of business entities available. The most common structures for foreign companies are:

1) Wholly Owned Subsidiaries ie WOS., 100% Indian Subsidiary

2) Joint Ventures with other Indian Companies subjected to Foreign Direct Investment rules.

3) Liaison Office: An LO serves as a representative office for the foreign parent company in India. It’s primarily responsible for promoting the parent company’s business interests, providing information about its products and services, and facilitating communication between the parent company and Indian customers. However, an LO is not permitted to engage in any profit-making activities in India.

4) Branch Office : A BO is an extension of the foreign parent company and can engage in a wider range of business activities, including marketing, import and export, and technical support services. However, a BO is generally restricted from manufacturing and processing activities in India. Profits earned by a BO are subject to Indian taxation.

5) Other options for foreign companies include setting up a Project Office, a wholly-owned subsidiary, or a joint venture with an Indian partner. The choice of entity depends on the foreign company’s business objectives, investment plans, and risk appetite.

Shareholders & Directors:

| Type of Company | Minimum Shareholders | Maximum Shareholders | Minimum Directors | Maximum Directors |

| Private Limited | 2 | 200 | 2 | 15 |

| Public Limited | 7 | Unlimited | 3 | 15 |

Minimum Capital:

There is no minimum required Paid up share capital that a NRI, Foreign Entity or Foreign National is required to invest in a company in India.

Procedure for Incorporation of an Indian Company:

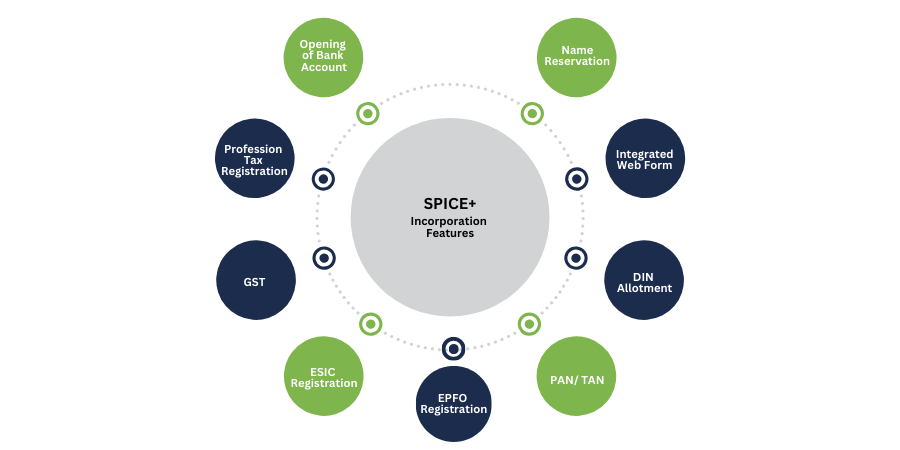

Keeping in view the ease of doing business, new form SPICe+ (Simplified Proforma for Incorporating Company electronically Plus) is notified for the incorporation of a company and incidental registrations. All the new company incorporations have to be done by the online filing of SPICe+ form. The other forms that need to be filed along with SPICe+ are AGILE-PRO, SPICe+AoA, SPICe+MoA and INC-9

Governing the web form:

Sections 4, 7, 12, 152 and 153 of the Companies Act, 2013 read with rules made thereunder.

Governing the web form:Purpose of the Web form:

Web form SPICe+ deals with the single application for reservation of name, incorporation of a new company, application for allotment of Director Identification Number ie.,DIN, application for PAN and TAN. This eForm is accompanied by supporting documents including details of Directors & subscribers, MoA, AoA and Consent of Directors. Once the eForm is processed and found complete, the company would be registered and CIN would be allocated. DINs are issued to the proposed Directors who do not have a valid DIN.

Maximum three Directors are allowed to use this integrated form for filing application for allotment of DIN while incorporating a company. Also PAN, TAN, GST registration, EPFO, ESIC and Opening of Bank account would get issued to the Company.

SPICe+ has been divided into two parts viz., SPICe+ Part A and SPICe+ Part B. SPICe+ Part A represents the section wherein all details with respect to name reservation for a new company has to be entered. Name reserved shall be valid for 20 days from the date of allotment.

SPICe+ Part B represents the section wherein all remaining details required for incorporation of a company have to be entered.

Documents Required for Registration by Foreign Entities:

1) Proof of the foreign company’s existence, such as a Certificate of Incorporation or equivalent document

2) MoA and AoA of the foreign companies.

3) Board resolution authorizing the establishment of the Indian entity.

4) Name of Nominee’s in case of incorporation of WOS

5) Identity proof and address proof of the directors and authorized representative

6) Digital Signature certificate of authorized representative

Note: that all foreign documents must be notarized and apostilled in the country of origin, and translated into English if they are not in English.

Documents Required by Foreign National/Non Resident Indian:

1) Proof of the foreign company’s existence, such as a Certificate of Incorporation or equivalent document

2) MoA and AoA of the foreign companies.

3) Board resolution authorizing the establishment of the Indian entity.

4) Name of Nominee’s in case of incorporation of WOS

5) Identity proof and address proof of the directors and authorized representative

6) Digital Signature certificate of authorized representative

Note: that all foreign documents must be notarized and apostilled in the country of origin, and translated into English if they are not in English.

Documents Required by Indian Director

1.KYC of Member and Nominee ie., PAN and AADHAR

2.Address Proof ie., any one of Latest Bank Statement/ Latest Electricity Bill/ Latest Mobile Bill/ Telephone Bill which is Not older than 60 days

3. Identity proof: Voter ID Card/ Driving License/ Passport Copy

4. Photograph of the promoters/ Directors

5. Email ID and Contact Details.

6. Digital Signature certificate (DSC)

Other Requirements:

1. Main Object or activities carried out by the Company.

2.Proof of Registered office address – Rent agreement/ Conveyance deed/Lease agreement.

3.Utility Bills of registered office address- Electricity Bill/ Water Bill/Telephone Bill which is not older than two months.

4. No Objection certificate from owner of the premises, if property is rented/ leased.

Process for Apostille and Notary of Documents:

- All the original documents shall be Notarized before apostille.

- Notarized documents shall be submitted with the Embassy or Consulate (Issuing office) of the Country for apostille.

- The issuing office shall validate the documents after making payment.

- After Validation of documents, issuing office shall issue apostilled documents

Post-Registration Compliance

Once foreign company is registered in India, it’s essential to

maintain compliance with the country’s regulatory requirements, such as:

1) Declaration for the Commence of business in Form INC-20A is to be filed with Registrar of Companies within 180 days of the date of incorporation of the company.

1) Filing annual financial statements and returns with the MCA

2) Complying with Indian tax laws and filing tax returns on time

3)Maintaining proper accounting records and statutory registers

4) Complying with labor laws, environmental regulations, and other sector-specific requirements.

FEMA Compliances:

Procedure for receiving Foreign Direct Investment in an India Company

An Indian company may receive Foreign Direct Investment under the two routes as given under:

i) Automatic Route:

FDI up to 100% is allowed under the automatic route in almost all the activities/sector. FDI in sectors /activities to the extent permitted under the automatic route does not require any prior approval either of the Government or the Reserve Bank of India. Sectors or Activities not permitted under automatic route have to take approval from FIPB ie., Government Route for investing in India.

Indian companies having foreign investment approval through the FIPB route do not require any further clearance from the Reserve Bank of India for receiving inward remittance and for the issue of shares to the non-resident investors.

The Indian company having received FDI either under the Automatic route or the Government route is required to report in the Form FCGPR, the details of the receipt of the amount of consideration for issue of equity instrument viz. shares or fully and mandatorily convertible debentures or fully and mandatorily convertible preference shares through an AD Category –I Bank, together with copies of the FIRC evidencing the receipt of inward remittances along with the Know Your Customer report on the non-resident investors from the overseas bank remitting the amount, to the Regional Office concerned of the Reserve Bank of India within 30 days from the date of receipt of inward remittances.

However, Companies Act, 2013 specifically provides for allotment of shares within 60 days from the date of inward remittance. Thus, it may be inferred that allotment shall be made within 60 days of inward remittance and FCGPR shall be filed within that duration.

After issue of shares ie., fully and mandatorily convertible debentures or fully and mandatorily convertible preference shares, the Indian company has to file the required documents in Form FCGPR with the bank in which funds were received. Bank will forward the FCGPR and the documents to the Regional office of Reserve Bank of India.

Sectors for which FDI is not allowed in India under the Automatic Route as well as under the Government Route: FDI is prohibited under the Government Route as well as the Automatic Route in the following sectors: 1)Lottery Business including Government, private lottery, online lotteries, etc. 2)Gambling and Betting including casinos etc. 3)Chit funds 4)Nidhi company 5)Trading in Transferable Development Rights 6)Real Estate Business or Construction of Farm Houses 7)Manufacturing of Cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes 8)Activities or sectors not open to private sector investment

- Atomic energy and

- Railway operations (other than permitted activities mentioned in entry 18 of Annex B).

Procedure after investment is made under the Automatic Route or with Government approval

a) On receipt of share application money:

Within 30 days of receipt of share application money/amount of consideration from the Foreign Entities or Foreign National or Non Resident Indian, the Indian company is required to report to the Regional Office concerned of the Reserve Bank of India, under whose jurisdiction its Registered Office is located, through bank in which funds have been received in Form ARF ie., Advanced Remittance Form.

b) Issue of shares:

Within 30 days from the date of issue of shares, a report in Form FCGPR should be filed with the Regional Office concerned of the Reserve Bank of India through the bank in which investment has been received.

Refund of Investment amount: In case, equity shares are not issued within 60 days of receipt of funds, the amount shall be refunded immediately to the non-resident investor.

Filing FLA Return: Every Indian company receiving FDI has to file Annual Return of Foreign Liabilities and Assets by 15th July of the relevant year. Non-filing of the return before the due date will be treated as a violation of FEMA and a penalty clause may be invoked for violation of FEMA.

Consequences of failure to comply with the above requirements

If any person contravenes any provision of this Act, or contravenes any rule, regulation, notification, direction or order issued in exercise of the powers under this Act, or contravenes any condition subject to which an authorization is issued by the Reserve Bank, he shall, upon adjudication, be liable to a penalty up to thrice the sum involved in such contravention where such amount is quantifiable, or up to two lakh rupees where the amount is not quantifiable, and where such contravention is a continuing one, further penalty which may extend to five thousand rupees for every day after the first day during which the contravention continues.

Process for Notary and Apostille of documents:

The Companies Act, 2013 requires the signatures of subscribers and identity or address proof to be notarized before a Notary public and apostille with Secretary of State’s office of that country as per the Hague Convention if both foreign national provides documents issued by the country.

Steps for Notary and Apostille of Documents:

Step 2: Contact the Secretary of State’s office in the state where the document was issued with all the certified true copy of the document. The Secretary of State’s office is responsible for issuing apostilles.

Step 3: Submit the document and pay the fee. The apostille Fee Varies by State to State.

Step 4: Once the apostille has been issued, it will be attached to the certified copy of the document and collect the apostille documents.